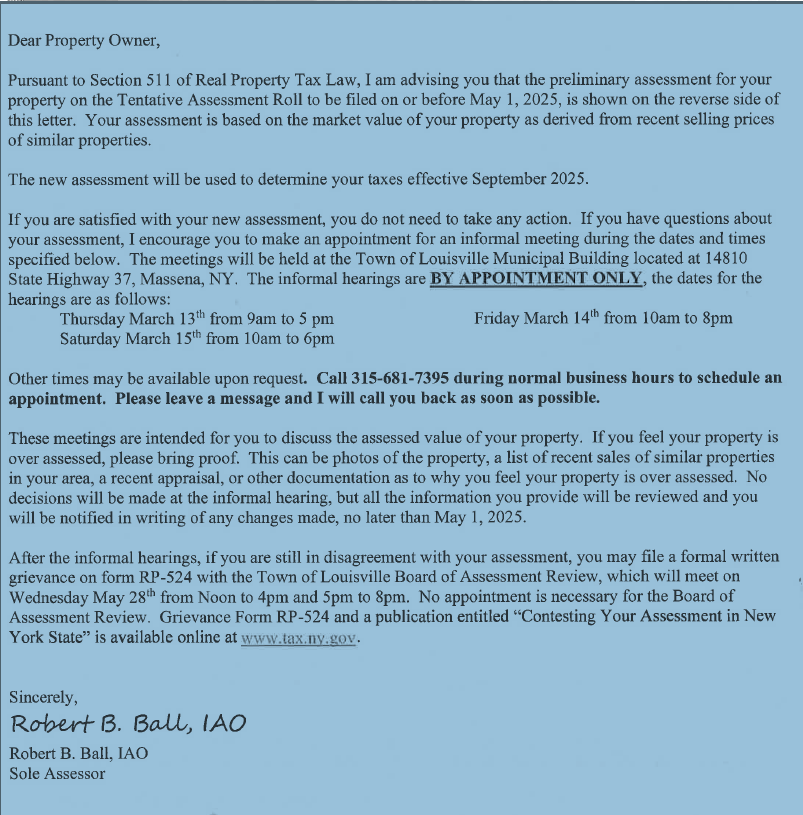

Assessor

Assessors are local government officials who estimate the value of real property within a county, city, or town, or village’s boundaries. It is the responsibility of the assessor to provide property owners with fair and accurate assessments. To estimate the market value of property, the assessor must be familiar with the local real estate market. You can click here to learn more about how assessors determine the value of property.

To look up the assessed value of your home or similar homes

Grievance Day will be held Wednesday, May 28th from Noon to 4pm and 5pm to 8pm. Use Form RP-524 to file a formal written grievance.

** Applications for filing a complaint and instructional booklets are available from your assessor, town clerk, the St. Lawrence County Real Property Tax Service Agency or by downloading the forms at https://www.tax.ny.gov/pit/property/contest/contestasmt.htm

CONTACT INFORMATION

Robert Ball, Assessor

robertball79@yahoo.com

315-681-7395

OFFICE HOURS

By Appointment Only on Wednesdays

Forms & Documents